Gideon company uses the allowance method of accounting – Gideon Company’s adoption of the allowance method for accounting has significantly impacted its financial reporting practices. This method offers distinct advantages and potential drawbacks, which this analysis will thoroughly explore. By examining the nuances of the allowance method, we aim to provide insights into its implications for Gideon Company’s financial management.

The allowance method enables Gideon Company to estimate and record uncollectible accounts receivable, ensuring a more accurate representation of its financial position. This approach aligns with industry best practices and enhances the reliability of financial statements.

Introduction

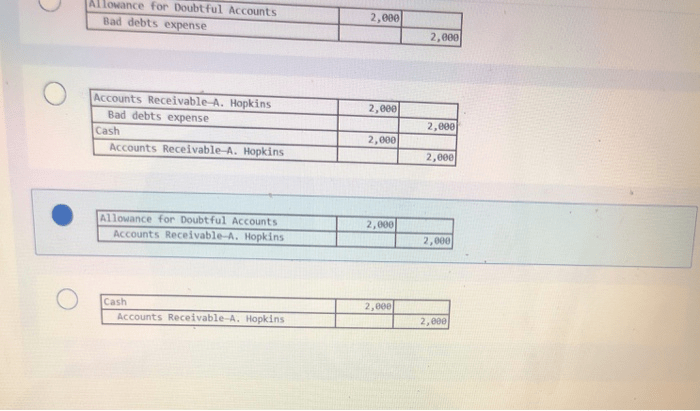

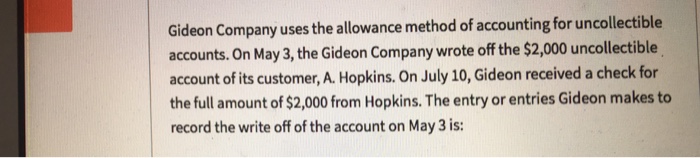

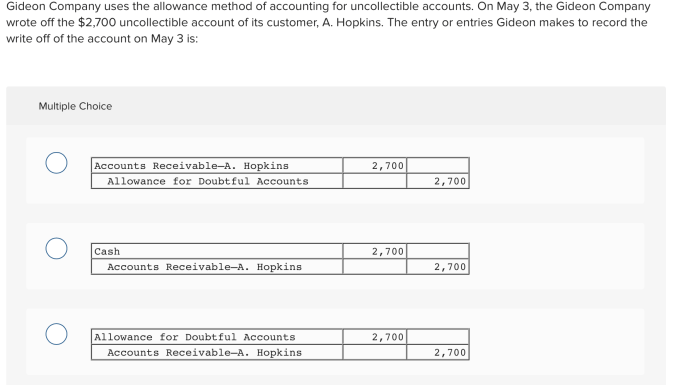

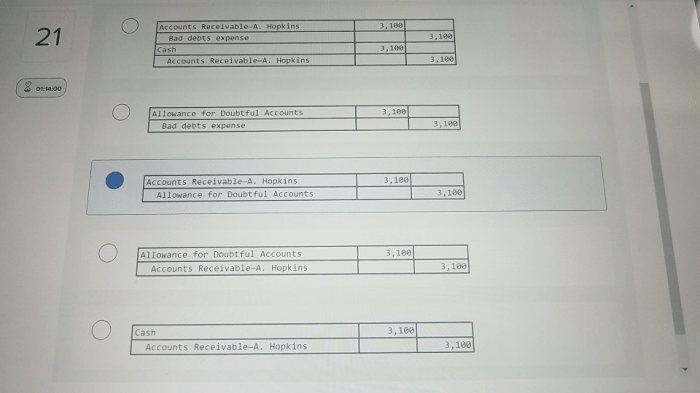

The allowance method of accounting is a technique used to estimate and record the amount of uncollectible accounts receivable. Under this method, a company creates an allowance account, which is a contra-asset account, to offset the accounts receivable balance.

Gideon Company uses the allowance method to account for bad debts. The company estimates the amount of uncollectible accounts receivable based on historical data and industry averages. This estimate is then used to create an allowance for doubtful accounts.

Advantages of the Allowance Method

There are several advantages to using the allowance method of accounting for bad debts:

- Conservatism:The allowance method is a conservative accounting method that results in a lower net income and higher expenses than the direct write-off method. This is because the allowance method recognizes the potential for bad debts even before they occur.

- Simplicity:The allowance method is a relatively simple accounting method to implement and maintain. It does not require the company to track individual customer accounts.

- Matching principle:The allowance method matches the expense of bad debts to the period in which the sales were made. This is in accordance with the matching principle of accounting.

Example

For example, Gideon Company estimates that 2% of its accounts receivable will be uncollectible. At the end of the year, the company has accounts receivable of $1,000,000. Gideon Company would create an allowance for doubtful accounts of $20,000 (2% x $1,000,000).

Disadvantages of the Allowance Method: Gideon Company Uses The Allowance Method Of Accounting

There are also some disadvantages to using the allowance method of accounting for bad debts:

- Estimation:The allowance method relies on an estimate of the amount of uncollectible accounts receivable. This estimate can be difficult to make accurately.

- Inaccuracy:The allowance method can result in an inaccurate estimate of the actual amount of bad debts. This can lead to the company overstating or understating its expenses and net income.

Potential Risks for Gideon Company, Gideon company uses the allowance method of accounting

Gideon Company faces the following potential risks when using the allowance method:

- Inaccurate estimation:If Gideon Company does not accurately estimate the amount of uncollectible accounts receivable, it could lead to the company overstating or understating its expenses and net income.

- Overstatement of assets:If Gideon Company overestimates the amount of uncollectible accounts receivable, it could lead to the company overstating its assets.

- Understatement of expenses:If Gideon Company underestimates the amount of uncollectible accounts receivable, it could lead to the company understating its expenses.

Alternatives to the Allowance Method

There are several alternative methods of accounting for bad debts, including:

- Direct write-off method:Under the direct write-off method, a company only recognizes bad debts when they occur. This method is simple to implement, but it can result in a volatile net income.

- Percentage of sales method:Under the percentage of sales method, a company estimates the amount of bad debts as a percentage of sales. This method is simple to implement, but it can be inaccurate if the company’s sales are not evenly distributed throughout the year.

Suitability of Alternatives for Gideon Company

The following table compares the suitability of the alternative methods of accounting for bad debts for Gideon Company:

| Method | Suitability for Gideon Company |

|---|---|

| Direct write-off method | Not suitable. This method would result in a volatile net income for Gideon Company because the company’s sales are not evenly distributed throughout the year. |

| Percentage of sales method | Suitable. This method is simple to implement and would provide a more accurate estimate of bad debts than the direct write-off method. |

Recommendations

Based on the analysis above, the following recommendations are made for optimizing Gideon Company’s use of the allowance method:

- Regularly review and adjust the allowance:Gideon Company should regularly review and adjust the allowance for doubtful accounts to ensure that it is accurate.

- Use multiple estimation methods:Gideon Company should use multiple estimation methods to improve the accuracy of the allowance for doubtful accounts.

- Consider using a rolling allowance:Gideon Company should consider using a rolling allowance, which would allow the company to smooth out the impact of bad debts on its net income.

FAQs

What are the key advantages of the allowance method for Gideon Company?

The allowance method allows Gideon Company to estimate and record uncollectible accounts receivable, resulting in a more accurate representation of its financial position and reduced risk of overstating assets.

Are there any disadvantages associated with the allowance method?

Potential disadvantages include the estimation uncertainty in determining the appropriate allowance amount and the potential for underestimating bad debts, which could impact financial performance.

How does the allowance method impact Gideon Company’s financial reporting?

The allowance method provides a more conservative estimate of accounts receivable, reducing the risk of overstating assets and improving the reliability of financial statements.