Myers company uses a flexible budget – Myers Company’s implementation of flexible budgeting serves as a captivating case study, showcasing the transformative power of this financial tool. By embracing flexibility in their budgeting process, Myers Company has gained a competitive edge, optimizing decision-making and driving organizational success.

Flexible budgeting empowers businesses to adapt to fluctuating market conditions, ensuring that financial plans remain aligned with operational realities. This dynamic approach enables companies to respond swiftly to unforeseen challenges and capitalize on emerging opportunities.

Flexible Budget Overview

A flexible budget is a type of budget that is designed to adjust automatically to changes in activity levels. This type of budget is based on the assumption that costs and revenues will vary with changes in activity, and it is designed to provide managers with a more accurate picture of the company’s financial performance under different operating conditions.

There are a number of benefits to using a flexible budget. First, it can help managers to better understand the relationship between costs and revenues. This information can be used to make more informed decisions about how to operate the company.

Benefits of Using a Flexible Budget, Myers company uses a flexible budget

- Improved accuracy

- Enhanced decision-making

- Increased efficiency

- Reduced costs

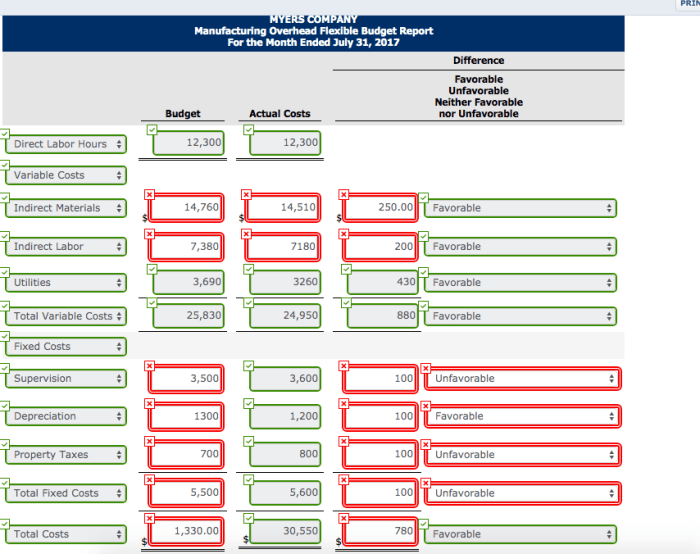

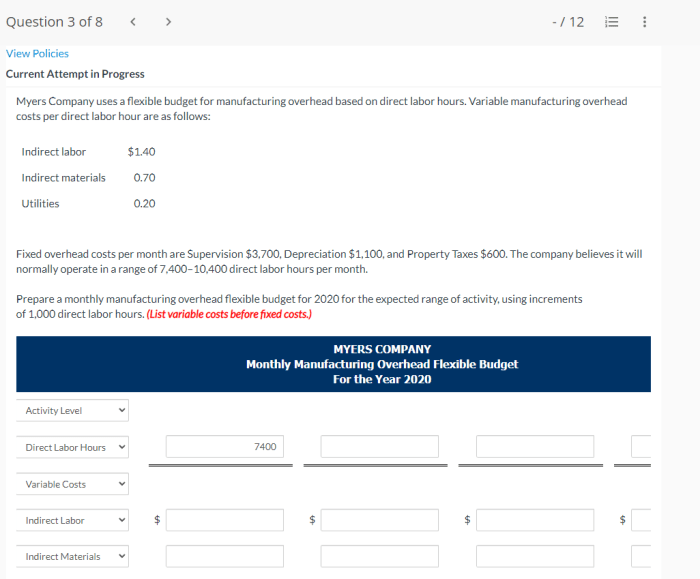

Myers Company’s Flexible Budget

Myers Company is a manufacturing company that uses a flexible budget to manage its operations. The company’s flexible budget is based on the assumption that its costs and revenues will vary with changes in production volume.

The following is an example of a flexible budget for Myers Company:

| Production Volume | Revenue | Variable Costs | Fixed Costs | Total Costs | Net Income |

|---|---|---|---|---|---|

| 10,000 units | $1,000,000 | $500,000 | $200,000 | $700,000 | $300,000 |

| 15,000 units | $1,500,000 | $750,000 | $200,000 | $950,000 | $550,000 |

| 20,000 units | $2,000,000 | $1,000,000 | $200,000 | $1,200,000 | $800,000 |

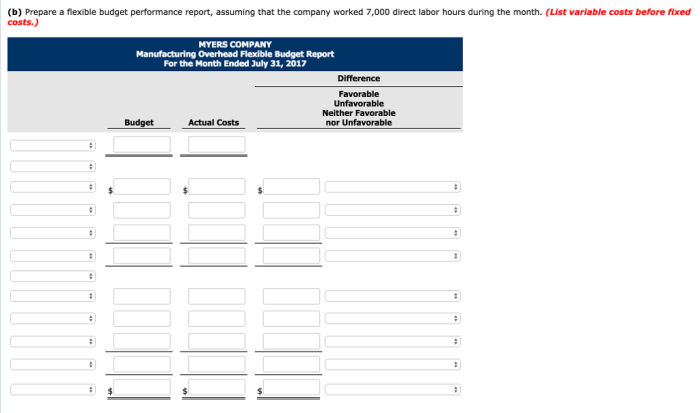

Variance Analysis

Variance analysis is a technique that is used to compare actual results to budgeted results. This information can be used to identify areas where the company is performing well and areas where it is underperforming.

The following is an example of a variance analysis for Myers Company:

| Production Volume | Actual Revenue | Actual Variable Costs | Actual Fixed Costs | Actual Total Costs | Actual Net Income | Revenue Variance | Variable Cost Variance | Fixed Cost Variance | Net Income Variance |

|---|---|---|---|---|---|---|---|---|---|

| 15,000 units | $1,450,000 | $725,000 | $200,000 | $925,000 | $525,000 | $50,000 | $25,000 | $0 | $25,000 |

Management Implications

Flexible budgets can be used for a variety of management decision-making purposes. For example, they can be used to:

- Set performance targets

- Evaluate actual performance

- Identify areas for improvement

- Make informed decisions about how to allocate resources

Myers Company has used flexible budgets to make a number of decisions, including:

- The decision to increase production from 10,000 units to 15,000 units

- The decision to purchase new equipment

- The decision to hire additional employees

Quick FAQs: Myers Company Uses A Flexible Budget

What are the key benefits of flexible budgeting?

Flexible budgeting enhances adaptability, improves financial planning, facilitates variance analysis, and supports informed decision-making.

How does variance analysis contribute to flexible budgeting?

Variance analysis enables the identification and interpretation of deviations between actual results and budgeted expectations, providing valuable insights for performance evaluation and corrective action.