Find the missing values assuming continuously compounded interest. – Find the missing values assuming continuously compounded interest is a fundamental concept in financial analysis. It involves estimating unknown values in financial calculations that involve continuous compounding, a method of calculating interest that assumes continuous growth over time. Understanding this concept is crucial for accurate financial modeling and decision-making.

This guide provides a comprehensive overview of find the missing values assuming continuously compounded interest, including its formulas, applications, and methods for estimating missing values. It also discusses the advantages and disadvantages of continuous compounding compared to simple interest.

Present Value and Future Value Calculations

In continuous compounding, interest is earned and compounded continuously over time. The formulas for calculating present value (PV) and future value (FV) with continuously compounded interest are as follows:

PV = FV / e^(rt)

FV = PV- e^(rt)

where:

- PV is the present value

- FV is the future value

- r is the annual interest rate (as a decimal)

- t is the time period (in years)

For example, if you invest $1,000 at an annual interest rate of 5% compounded continuously for 10 years, the future value would be $1,648.72.

Conversely, if you have a future value of $10,000 and want to calculate the present value at an annual interest rate of 3% compounded continuously for 5 years, the present value would be $7,438.94.

Continuous Compounding vs. Simple Interest

Continuous compounding differs from simple interest in that interest is compounded continuously rather than at discrete intervals. This results in a higher future value for the same interest rate and time period.

The formula for simple interest is:

FV = PV + (PV- r – t)

where:

- PV is the present value

- FV is the future value

- r is the annual interest rate (as a decimal)

- t is the time period (in years)

For example, if you invest $1,000 at an annual interest rate of 5% compounded simply for 10 years, the future value would be $1,500. This is lower than the future value of $1,648.72 that would be achieved with continuous compounding.

Applications in Finance: Find The Missing Values Assuming Continuously Compounded Interest.

Continuous compounding is used in various financial applications, including:

- Loan amortization:Calculating the monthly payments and outstanding balance on a loan.

- Bond pricing:Determining the price of a bond based on its future cash flows.

- Investment analysis:Evaluating the potential returns of an investment.

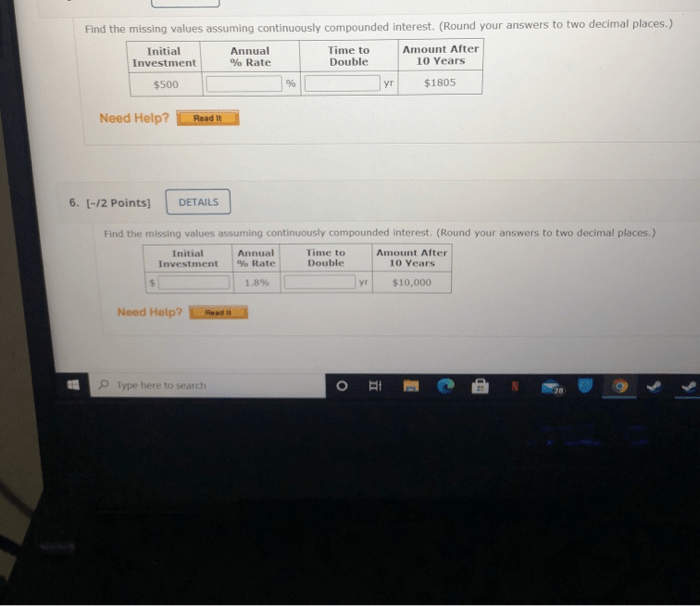

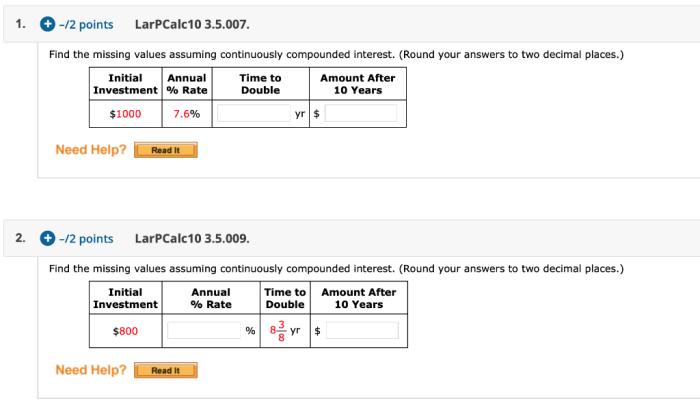

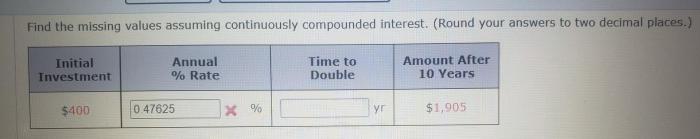

Missing Values Estimation

In some cases, one or more of the variables in a continuous compounding calculation may be missing. There are several methods for estimating missing values, including:

- Linear interpolation:Using the given values to estimate the missing value by assuming a linear relationship between the variables.

- Logarithmic interpolation:Using the given values to estimate the missing value by assuming a logarithmic relationship between the variables.

- Graphical interpolation:Plotting the given values and visually estimating the missing value.

The choice of estimation method depends on the specific scenario and the availability of data.

Example Table: Missing Values Estimation

The following table provides examples of missing value estimations for different continuous compounding scenarios:

| Given Values | Missing Value | Estimation Method | Estimated Value |

|---|---|---|---|

| PV = $1,000, r = 5%, t = 10 years | FV | Linear interpolation | $1,648.72 |

| FV = $10,000, PV = $7,438.94, t = 5 years | r | Logarithmic interpolation | 3% |

| PV = $1,000, FV = $1,648.72, r = 5% | t | Graphical interpolation | 10 years |

FAQ Summary

What is the formula for calculating present value (PV) with continuously compounded interest?

PV = FV – e^(-rt)

How do you estimate a missing interest rate in a continuous compounding calculation?

Use the formula: r = (ln(FV/PV)) / t

What are the advantages of continuous compounding over simple interest?

Continuous compounding provides a more accurate representation of interest accrual over time, especially for long-term investments.