Introducing finance in the classroom answer key, an invaluable resource designed to enhance financial literacy among students. This comprehensive guide delves into the fundamental principles of finance, providing real-world examples and practical strategies to empower young minds with the knowledge and skills necessary to navigate the complexities of personal finance.

Throughout this answer key, students will embark on a journey of financial discovery, exploring concepts such as budgeting, saving, investing, and credit. They will gain a deep understanding of financial planning and management, learning how to set financial goals, track expenses, and make informed decisions about credit and debt.

Finance Concepts and Terminology

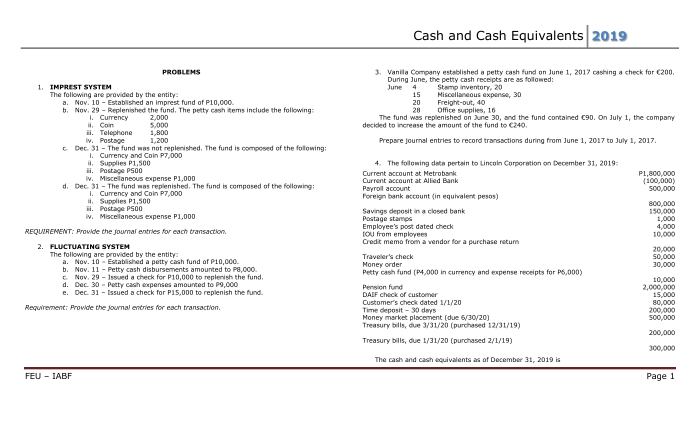

Finance encompasses a vast array of concepts and terminologies that form the foundation of financial literacy. It involves understanding the principles of budgeting, saving, investing, and credit, which are essential for effective financial management. These concepts are not merely theoretical but have practical applications in our daily lives, helping us make informed financial decisions.

Budgeting, at its core, is the process of planning and controlling our financial resources. It involves creating a detailed plan that Artikels our income, expenses, and savings. By adhering to a budget, we can ensure that our spending aligns with our financial goals and avoid overspending.

Saving refers to setting aside a portion of our income for future use. It is crucial for building an emergency fund, achieving financial goals, and securing our financial future. Investing, on the other hand, involves using our savings to generate additional income through various investment vehicles such as stocks, bonds, and mutual funds.

Credit plays a significant role in our financial lives. It allows us to borrow money to make purchases or investments. However, it is important to use credit responsibly and understand the associated costs, such as interest rates and fees. Financial literacy empowers us to navigate these concepts effectively, enabling us to make informed financial decisions and achieve our financial objectives.

Financial Planning and Management

Effective financial planning and management are essential for achieving financial stability and success. It involves creating a comprehensive plan that Artikels our financial goals, strategies to achieve them, and a timeline for implementation.

A personal budget is a cornerstone of financial planning. It provides a clear picture of our income and expenses, allowing us to identify areas where we can optimize our spending and allocate funds more effectively. Tracking our expenses is crucial for understanding our spending patterns and making informed adjustments.

Setting financial goals is essential for providing direction and motivation for our financial planning. These goals can range from short-term objectives, such as saving for a vacation, to long-term aspirations, such as retirement planning. Developing a plan to achieve these goals involves identifying the necessary steps, timelines, and potential obstacles.

Financial institutions, such as banks, investment firms, and insurance companies, play a vital role in financial planning and management. They offer a range of products and services, including savings accounts, investment options, and insurance policies, that can help us achieve our financial objectives.

Understanding the role of these institutions and how to manage our finances responsibly is crucial for long-term financial success.

Investment Strategies: Finance In The Classroom Answer Key

Investing is a powerful tool for growing our wealth and achieving our financial goals. It involves allocating our savings into various investment vehicles, such as stocks, bonds, and mutual funds, with the potential to generate returns over time.

Diversification is a key principle of investment strategies. It involves spreading our investments across different asset classes and investments to reduce risk. By diversifying our portfolio, we can mitigate the impact of fluctuations in any single investment or market sector.

Risk management is another crucial aspect of investment strategies. It involves assessing and managing the potential risks associated with different investments. Understanding our risk tolerance and investing accordingly is essential for preserving our capital and achieving our financial objectives.

Long-term investing is a fundamental principle for successful investing. Historical data shows that markets tend to trend upwards over the long term, despite short-term fluctuations. By investing for the long term, we can benefit from the power of compounding, where our returns are reinvested and generate additional returns over time.

Financial Markets and Institutions

Financial markets are platforms where buyers and sellers come together to trade financial instruments, such as stocks, bonds, and currencies. The stock market, in particular, plays a crucial role in facilitating capital formation and economic growth.

Financial institutions, such as banks, investment firms, and insurance companies, are key players in financial markets. They provide essential services, such as facilitating transactions, managing investments, and providing insurance against financial risks.

Economic events and government policies can significantly impact financial markets. Factors such as interest rate changes, inflation, and economic growth can influence the performance of stocks, bonds, and other financial instruments. Understanding the impact of these factors is crucial for making informed investment decisions.

Consumer Finance

Consumer finance encompasses the financial decisions and products that individuals use in their everyday lives. It includes credit cards, loans, and mortgages, which can be valuable tools for financing purchases and achieving financial goals.

Understanding interest rates and loan terms is essential for making informed decisions about credit products. Interest rates determine the cost of borrowing money, and loan terms Artikel the repayment schedule and other important details.

Overspending and financial irresponsibility can lead to significant financial difficulties. It is crucial to avoid excessive debt and manage our finances responsibly to maintain financial stability and well-being.

Expert Answers

What is the importance of financial literacy?

Financial literacy empowers individuals to make informed decisions about their finances, enabling them to manage their money effectively, plan for the future, and achieve their financial goals.

How does this answer key support financial planning?

This answer key provides step-by-step guidance on creating a personal budget, setting financial goals, and developing a plan to achieve them, fostering responsible financial habits.

What are the key principles of investment strategies?

This answer key introduces the fundamentals of investment strategies, including diversification, risk management, and long-term investing, empowering students to make informed investment decisions.